From Idea to Execution: Build and Trade Quantitative Systems with Python

Validate your edge, build robust backtests, forward test and live trade with software you fully own and control

Immediate access • 50 seats only

What You'll Get

My goal with this course is to share some of my codebase, so you will have:

Your own multiple-asset daily backtester written in Python

The implementation of two strategies from papers

The implementation of two original strategies

Execution code to forward test and live trade using Interactive Brokers

Private Community Access

Who is this course for?

I’ve been trading systematically since completing my Master’s in Computer Science at Georgia Tech.In 2024, I launched quantitativo.com to share and exchange ideas in quantitative trading. Since then, I’ve started managing client accounts, trading systems I’ve developed over the years.Since launching the site, I’ve received hundreds of messages asking me to share my codebase, frameworks, and processes.This course is my response to that demand—from the 6,000+ readers of the newsletter and growing.It’s built for the readers who asked for it—especially those who already have basic coding skills and want more flexibility to turn their ideas into executable code—for those who know they could learn it all themselves, but want to accelerate the process and save time.

Content details

The course has 15 modules. Each module has:

Clear, concise, and thoughtfully designed explanations of the concepts and theory, crafted to provide you with a deep understanding of the material in an engaging and easy-to-follow way. No fluff, just actionable insights you can immediately use.

The codebase so you can apply the concepts you learn hands-on, reinforce your understanding, and build coding fluency.

Once you enroll, you'll get immediate access to all content, so you can learn at your own pace and go through the modules in the order that works best for you.I know there are courses out there that try to cover everything under the sun when it comes to systematic trading—dozens of frameworks, multiple instruments, and a myriad of techniques, all crammed into one. I take a different approach: focus on fewer things, but do them well—and with real depth.

Modules

Introduction

A Mean Reversion Idea

Testing for an Edge

Designing a Multi-Asset Daily Backtester

Implementing the Backtester (1/2)

Implementing the Backtester (2/2)

Metrics and Plots

Testing Our Engine

Diversification and Risk (1/2)

Diversification and Risk (2/2)

A Market Neutral Strategy

An Intraday Momentum Strategy

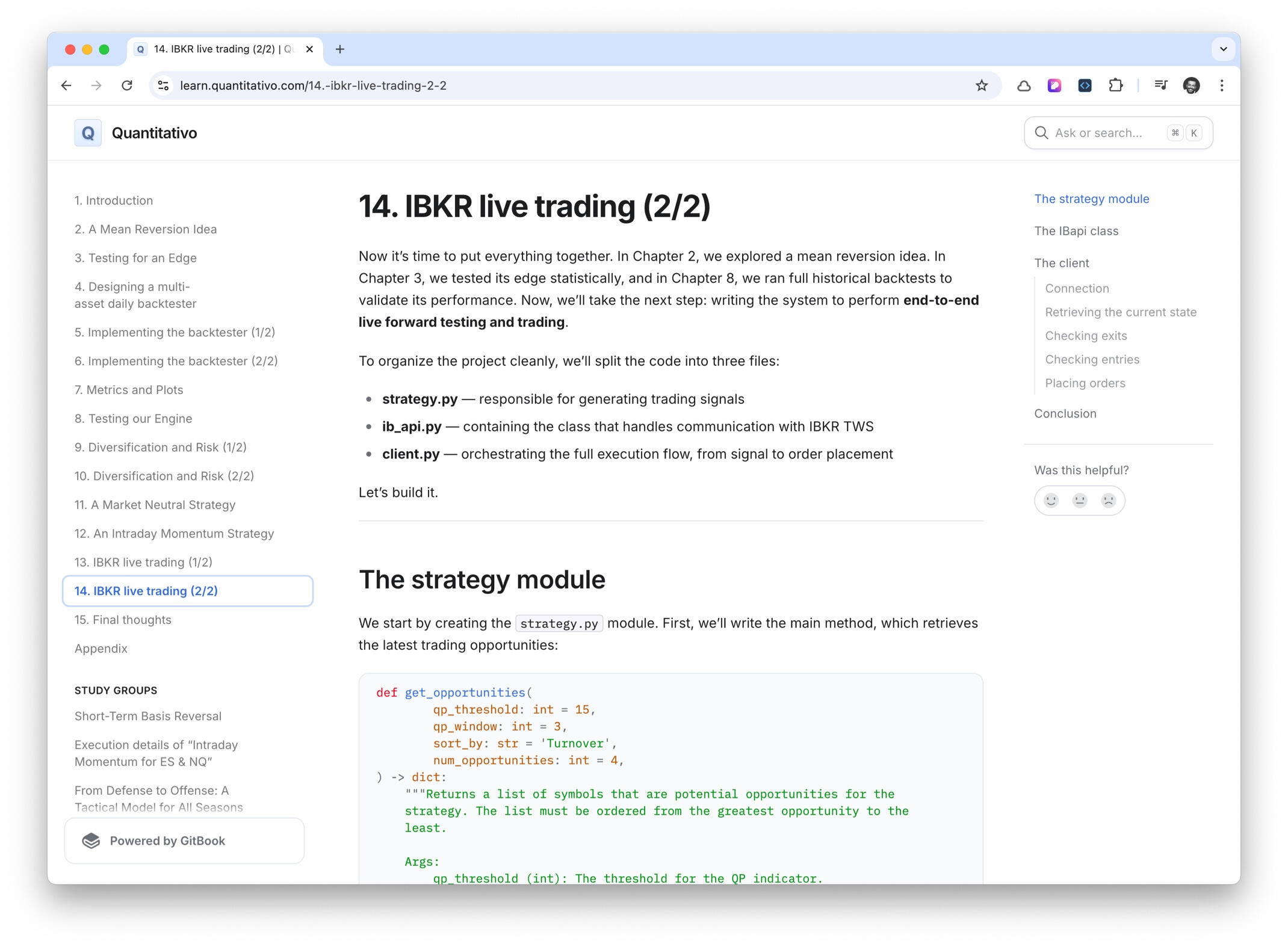

IBKR Live Trading (1/2)

IBKR Live Trading (2/2)

Final Thoughts

Private Community Access

You’ll join our private community for systematic traders — a place to explore ideas, exchange insights, and discuss technical and strategic challenges of building real-world trading systems.

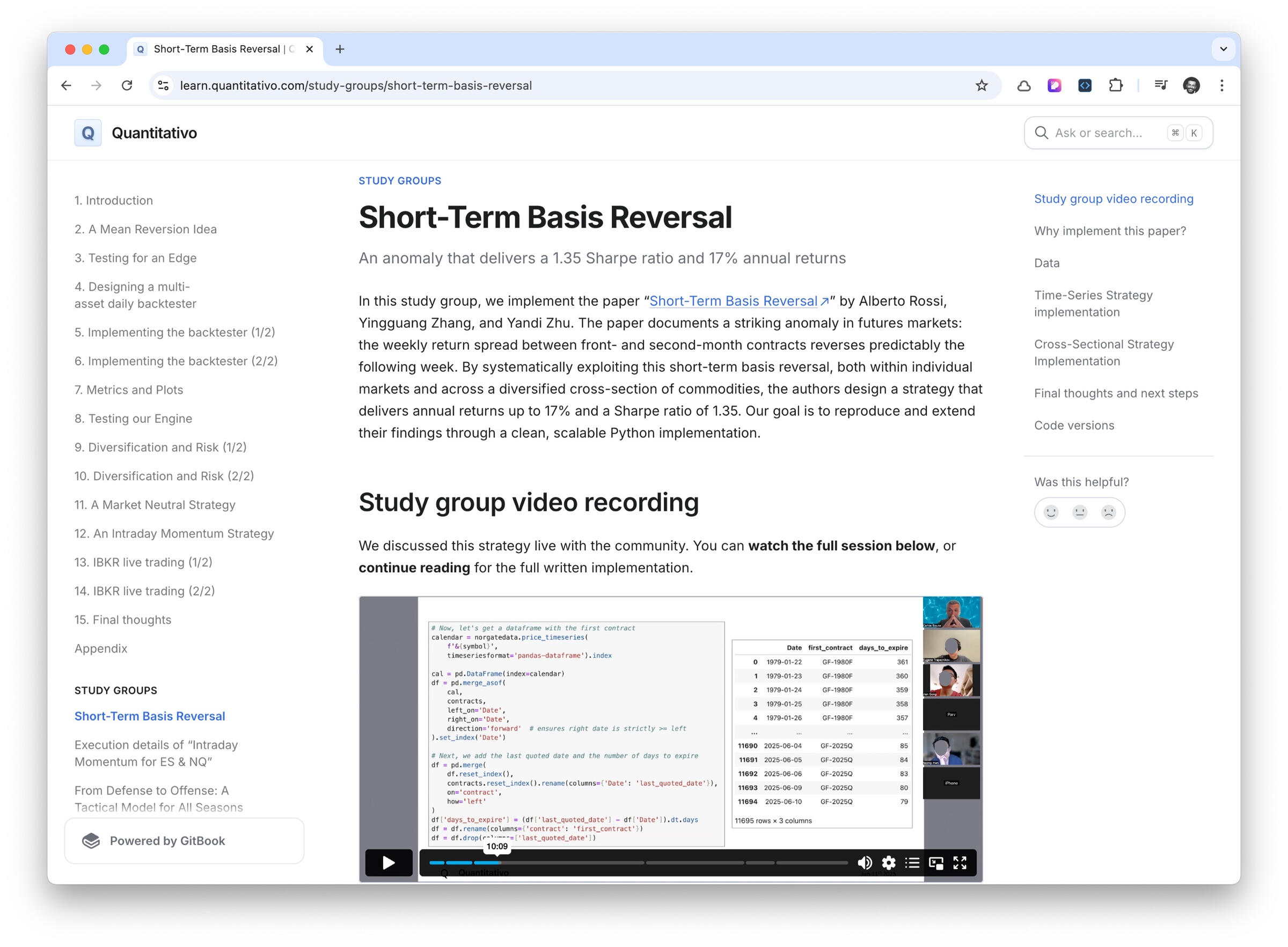

Live Study Groups + Ever-Growing Library

You’ll also get access to live study groups hosted via Zoom — where we dissect papers, share code, and dive into advanced techniques. Each session is recorded and added to the growing course library.

💬 What people are saying

“The course material is amazing, it's not a place for copy and paste, you actually understand what you are doing and can apply it to your own ideas.”

Sven“The course is super valuable, practical, and insightful. I found it very beneficial.”

Anonymous“Really interesting course that shows how to implement and backtest a trading idea in Python. Best part is using the learnings to implement new trading systems from study papers.”

Timo"This course is amazing -- especially in its clear focus. So many courses try to cover too many things, and this one just gives you what you need, with no fluff!”

Matt“I enjoyed the course a lot, it solved a lot of fundamental doubts I had on the strategy development process.”

Anonymous“I loved the ideas shared by Carlos, both in terms of quality and quantity. Also, we can get implementation suggestions from other quants who often have clever ideas on how to improve implementation in simple ways.”

Davin“The course is excellently structured, easy to follow, and offers a solid foundation for anyone interested in diving deeper into systematic trading. Phenomenal work, Carlos!”

Max“Carlos's teaching style is sharp and to the point—perfect for quants who want actionable tools, amazing guy with an amazing course!”

Buzz

Pricing & Access

💎 Price: $990

🎟️ Seats: 50

🔓 Access: Immediate upon checkout

Support

I’ll be available for questions via email, and I’m holding regular office hours for enrolled students. This cohort is limited to 50 people so I can provide direct support and maintain the level of quality I aim for.

FAQ

I have no coding experience. Zero. Is this course for me?

No, it isn’t. You’ll need to learn how to code first. Basic Python and familiarity with Pandas and NumPy should be enough to follow along.I know basic Python. How can I be sure I’ll be able to follow the course?

Take a Python/Pandas/NumPy refresher course (there are many great free options online). If you can complete it, you’ll be fine. Also, check out the tutorial A Trend Factor that I wrote a while ago. If you can follow it, you’re good to go.Will you be available to answer questions and provide support?

Yes. I’ll answer questions via email and also be available for office hours.Will you offer this course again?

Future cohorts are not guaranteed.